COVID-19 Governor's Update as of 3-31-20

I want to share a few important updates that include the coronavirus, mortgage relief for Connecticut residents and businesses, helpful information from the federal government for small businesses as well as a couple of local highlights.

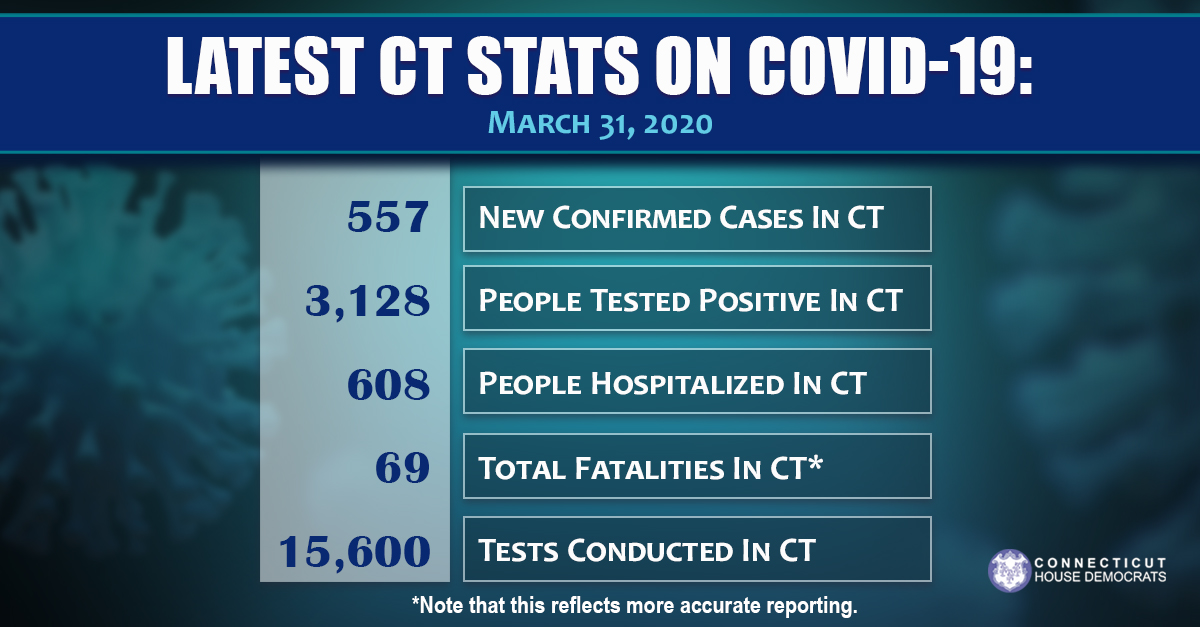

UPDATE: As of March 31

Governor Ned Lamont announced details on the latest collaboration to assist in the state’s coordinated response to the COVID-19 pandemic. He is appointing the CEOs of three of the largest hospital systems in Connecticut – Hartford HealthCare, Nuvance Health, and Yale New Haven Health – to serve as co-chairs of the Governor’s Health System Response Team.

Also, he shared good news for small businesses – the sales and occupancy tax payments can be deferred to May to provide some administrative relief during this time. For more information, and to determine which businesses qualify: https://portal.ct.gov/DRS/COVID19/DRS-COVID-19-Response-FAQ.

And today, the governor announced an important mortgage payment relief agreement with over 50 credit unions and banks in Connecticut that will help state's residents and businesses who are facing hardship caused by this pandemic. The agreement includes:

- 90-day grace period for all mortgage payments

- Relief from fees and charges for 90 days

- No new foreclosures for 60 days

- No credit score changes for accessing relief

For participating lenders please follow this link and to read the full governor's press release, along with an FAQ, please click HERE.

Read all of the emergency orders issued during this emergency here, and read all of the news briefings here. Stay up-to-date on the state's COVID-19 response at ct.gov/coronavirus.

As you may know, last week, Congress passed the Coronavirus Aid, Relief, and Economic Security Act, which was signed into law by President Trump.

The act includes several provisions and I will be sharing more information separately. Addressed below are questions relating to support for small businesses.

Small Business Support

For a detailed small business owner’s guide please click here.

What relief is included for small businesses?

- Paycheck Protection Program (PPP): The law includes nearly $350 billion to create a Paycheck Protection Program that will provide small businesses, nonprofits, and other entities with zero-fee loans of up to $10 million based on average monthly payroll costs. Up to eight weeks of average payroll, mortgage interest, rent, and utility payments can be forgiven if the business retains its employees and their salary levels. Principal and interest payments can be deferred for up to a year, and all SBA borrower fees are waived. This temporary emergency assistance through the U.S. Small Business Administration (SBA) and the Department of Treasury can be used in coordination with other COVID-financing assistance established in the law or any other existing SBA loan program.

- Small Business Administration (SBA) Loans: The law also includes $17 billion to further ease the burden on small businesses that use SBA loan products. Under the law, the SBA will cover all loan payments for existing SBA borrowers, including principal, interest, and fees, for six months. The loan amount is based on average total monthly payments for payroll for the 12-week period beginning February 15, 2019, or at the election of the eligible recipient, March 1, 2019, and ending June 30, 2019.

- Emergency Economic Injury Grants: The law includes $10 billion in funding for a provision to provide an advance of $10,000 to small businesses and nonprofits that apply for an SBA economic injury disaster loan (EIDL) within three days of applying for the loan. EIDLs are loans of up to $2 million that carry interest rates up to 3.75% for companies and up to 2.75% for nonprofits, as well as principal and interest deferment for up to 4 years. The loans may be used to pay for expenses that could have been met had the disaster not occurred, including payroll and other operating expenses.

- The EIDL grant does not need to be repaid, even if the grantee is subsequently denied an EIDL, and may be used to provide paid sick leave to employees, maintaining payroll, meet increased production costs due to supply chain disruptions, or pay business obligations, including debts, rent and mortgage payments.

- Refundable tax credits: IRS will be posting information soon on these credits on its website (www.irs.gov), including information on how to obtain advance payment of these credits.

- Payroll taxes: The law defers payroll through the end of 2020. Deferred taxes will not become due until end of 2021 and end of 2022, with 50% of the liability being paid at each date.

- Employee retention tax credit: available for struggling businesses that are not eligible or choose not to participate in the new SBA Paycheck Protection Program.

Is my small business eligible for relief?

- Paycheck Protection Program (PPP): This relief is available for small businesses, 501(c)(3) nonprofits, 501(c)(19) veterans organizations, or Tribal businesses with not more than 500 employees who were in operation on February 15, 2020. It is also available to sole proprietorships, independent contractors, and eligible self-employed individuals.

- Small Business Administration Loans: This relief will be available to existing SBA loan borrowers and new borrowers who take out an SBA loan within six months after the president signs the law. Each program has different requirements, go here for more details.

- Emergency Economic Injury Grants: The grant is available to small businesses, private nonprofits, sole proprietors and independent contractors, tribal businesses, as well as cooperatives and employee-owned businesses. Eligible grant recipients must have been in operation on January 31, 2020.

- Refundable tax credits: The law makes the credits available for private-sector employers that are required to offer coronavirus related paid leave to employees.

- Payroll taxes: Any business that does not have a loan forgiven under the new SBA Paycheck Protection Program is eligible for the payroll tax deferral.

- Employee retention tax credit: The law provides a refundable payroll tax credit for 50% of wages paid by employers to furloughed or reduced-hour employees during the COVID-19 crisis.

If I receive a stimulus check from the federal government, will it impact my ability to file for bankruptcy?

- No. Under this law, stimulus checks from the federal government cannot be used to determine whether you are eligible for filing bankruptcy.

- If you file for Chapter 13 bankruptcy, you will not have to turn your stimulus check over to your creditors. This new relief will be available for one-year.

What assistance is there for nonprofits?

- Nonprofits are eligible for payroll taxes deferment (see above).

- Nonprofits are eligible for the Paycheck Protection Program (see above).

- The law also allows any mid-sized nonprofit (between 500 and 10,000 employees) to get access to quick, low cost, government guaranteed credit through their local lender or financial institution. The Treasury Department and Federal Reserve will have a degree of flexibility in designing the new program, but the expectation is for loan terms to last for no more than five years and to cover up to 100% of payroll over the previous 180 days, or 50% of revenues for the past year, for eligible organizations. Borrowers will also commit to rehiring their workforce back to pre-existing levels upon the end of the COVID-19 health emergency.

Additional Notes:

If you haven’t already written a positive message in chalk, or had your child draw something on your driveway or sidewalk, this is a fun family activity to do together. And while you are at it, be sure to take a photo and send it to positivethoughts@branford-ct.gov for posting.

Also, The Daniel Cosgrove Animal Shelter in Branford has suspended all volunteer activity for a few weeks and the building is closed to walk-in visitors. For more information, please visit them here or call 203-315-4125.