Newsletter

August 18, 2021It's hard to believe we are heading into the last weeks of August. Maybe you are getting ready to send children off to college or maybe you are preparing your little one for their first school experience. Or maybe you're trying to squeeze as much as you can out of these last few weeks of summer. I'm wishing all of us the very best at enjoying whatever the moment brings us.

In this issue you'll find more information on the Earned Income Tax Credit, a historic SNAP benefits update, an upcoming event on composting (one of my favorite things), and an exciting announcement about my Youth Cabinet.

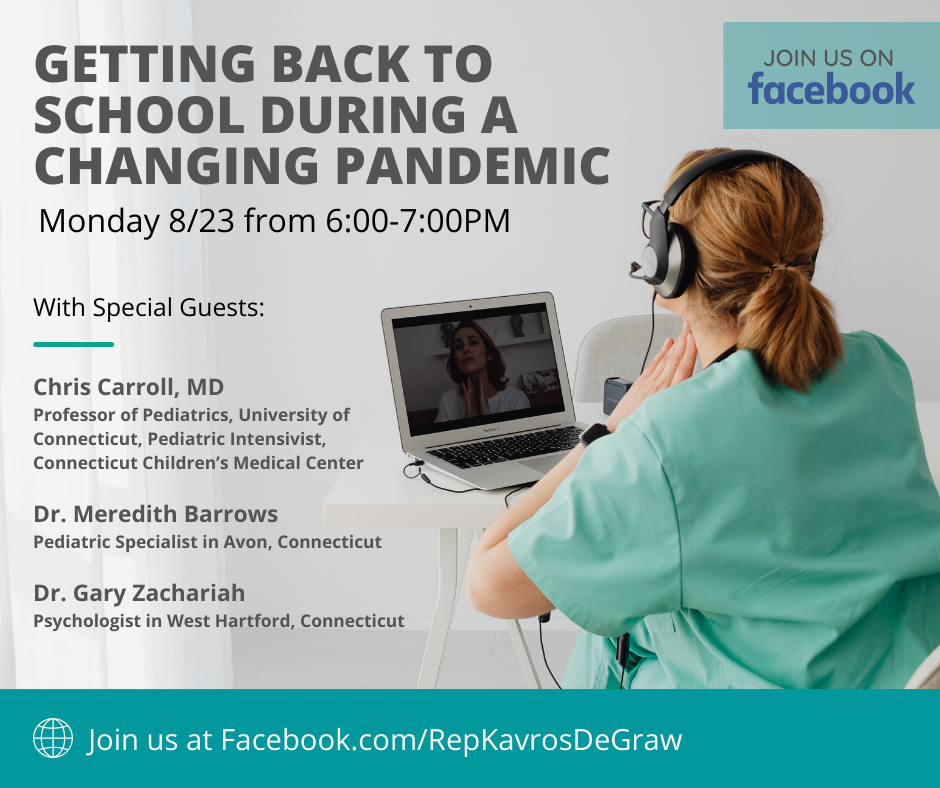

Additionally, on Monday, I'll be hosting a conversation with a local pediatrician, child psychologist, and doctor from CCMC, on Facebook at 6 p.m., "Getting Back to School Safely During a Changing Pandemic."

Also, another friendly reminder that we are in tax free week for your back-to-school shopping needs. As always, if there is anything I can help you with, please reach out.

Have a great week.

| CT EARNED INCOME TAX CREDIT INCREASING UNDER NEW STATE BUDGET |

Governor Ned Lamont has announced that thousands of low-to-moderate income working individuals and families in Connecticut will see a significantly larger state tax refund as the Connecticut Earned Income Tax Credit is scheduled to increase from its most recent rate of 23% of the federal credit to 30.5% this year, according to a press release.

The rate increase was included as part of the fiscal year 2022-2023 biennial state budget the governor signed into law earlier this summer. It will result in additional $40 million being delivered to the nearly 195,000 households that are eligible for the tax credit, for a total of $158 million.

The Connecticut Earned Income Tax Credit is a refundable state income tax credit for low-to-moderate income working individuals and families that mirrors the federal earned income tax credit. To qualify, filers must have eligible earned income and an adjusted gross income that is less than:

- $51,464 ($57,414 married filing jointly) with 3 or more qualifying children;

- $47,915 ($53,865 married filing jointly) with 2 qualifying children;

- $42,158 ($48,108 married filing jointly) with 1 qualifying child; or

- $15,980 ($21,920 married filing jointly) with no qualifying children.

In 2020, approximately 175,000 households in Connecticut, which included more than 220,000 children and other dependents, benefited from the credit.

| SNAP BENEFITS TO INCREASE IN OCTOBER |

I am pleased to report that the Biden Administration and the U.S. Department of Agriculture (USDA) have approved a significant and permanent increase in the amount of food stamp assistance available to families in need.

The pandemic further confirmed what activists have been saying all along: inadequate assistance from the Supplemental Nutrition Assistance Program (SNAP) forced many households to simply go hungry as the funds dwindled toward the end of the month.

Starting in October, SNAP benefits will rise an average of 25 percent—a permanent change that will benefit our nation's 42 million SNAP beneficiaries. As a result, the average SNAP benefit – excluding additional funds provided as part of pandemic relief – will increase by $36.24 per person, per month, beginning October 1, 2021.

This additional assistance will help individuals and families maintain a healthy diet and keep food on the table both during and after these uncertain times.

Click here to learn more about Connecticut's SNAP program, including information on how to apply for food assistance.

| COMPOSTING BEYOND THE GARDEN |

I couldn't wait to share this information I received with you. This topic, as you know, is close to my heart.

Composting

Beyond the Garden:

Sustainable CT Funding

Helps It Grow

Join us on August 26, 10-11:30 a.m.,

for a webinar on Sustainable CT

composting success stories

This isn't your grandmother's garden compost. Learn how multiple communities in Connecticut have taken composting to a whole new level with a variety of successful composting programs, and received funding from Sustainable CT to help make them happen. Presenters will address in-community aerobic composting, commercial in-vessel composting, school composting, and transfer station-based food waste hauling. Presentations will be made by Peels and Wheels Composting and Planet New Canaan, along with the towns of Greenwich, New Canaan, and Stamford. They'll cover composting methods, implementation, and lessons learned along the way. Grandma would approve.

| YOUTH CABINET SET TO LAUNCH |

Calling all high schoolers! I'm launching my Youth Cabinet, which is a non-partisan initiative to provide high school students in Avon & Canton an opportunity to learn more about the policy making process at our State Legislature. Members of the cabinet get to share their ideas about solving issues that impact them most. The cabinet will meet once a month with me and local community leaders.

Each meeting will be focused on a particular issue area, allowing students and myself the space to have an in-depth discussion about the ways in which specific policies and proposals influence their lives and community. My hope is that we will come up with an idea for a bill that can be submitted and followed throughout the legislative process. Stay tuned for the time and date of the first meeting which will be held next month at Ben & Jerry's in the Canton Shops - and all are welcome to attend!

| PLEASE JOIN ME FOR "GETTING BACK TO SCHOOL SAFELY DURING A CHANGING PANDEMIC" ON FACEBOOK |

As a parent in the time of COVID, it can be confusing to sort the significant volume of information coming at us daily--what is accurate or inaccurate when it comes to vaccines, masking, positivity rates, testing, and our children's mental health. That's why I have gathered three local experts in children's health to help us sort through these topics.

Dr. Meredith Barrows, M.D., local pediatrician; Dr. Chris Carroll, M.D., Professor of Pediatrics, University of Connecticut and Pediatric Intensivist, Connecticut Children's Medical Center; and Dr. Gary Zachariah, local psychologist and family therapist. We will be together on my State Representative Facebook Live page this coming Monday, August 23 at 6 p.m. I hope you'll join us.

| A REMINDER: SALES TAX FREE WEEK ENDS SATURDAY! |

Hurry! Sales Tax Free week ends Saturday!

Retail purchases of most clothing and footwear items priced under $100 are exempt from the Connecticut sales and use tax. The exemption during Sales Tax Free Week applies to each eligible item costing under $100, regardless of how many of those items are sold to a customer on the same invoice.

Many retailers in Connecticut offer additional clothing and footwear discounts during Sales Tax Free Week, resulting in even more savings for shoppers.

Specific information on Connecticut’s Sales Tax Free Week, including a listing of individual items that are exempt or taxable, can be found by visiting the Department of Revenue Services website.