Rep. Berger-Girvalo Legislative Update

April 18, 2022Dear Neighbor,

I hope you and your family have been well. Last week was a busy week for me with public hearings wrapping up and a long session Wednesday where several bills were voted on. Below I will recap what happened in this session.

To those who celebrated, I hope you had a fun and joyful Easter, Passover, and Ramadan. Don't forget, the last day to file taxes is today!

Here is some information I hope you find useful, including:

- CGA Kickball Classic

- Electric Vehicle Day at the Capitol

- Recap of Last Week's Session

- Breakdown of the Legislative Process

- Resources to Navigate the 2022 Session

- Today is The Last Day to File Taxes

- Renters Rebate Program

- Utility Cost Assistance

- Mental Health Service

- Here to Help

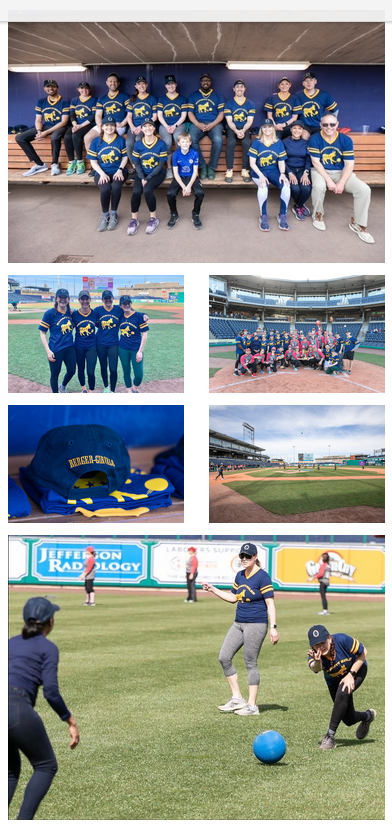

CGA KICKBALL CLASSIC

Last Monday was the first CGA Kickball Classic. The Connecticut House Democrats and Connecticut House Republicans came together to raise money for Connecticut Foodshare. Thank you to Hartford Yard Goats for hosting us at the amazing Dunkin' Donuts Park!

ELECTRIC VEHICLE DAY AT THE CAPITOL

Last week was Electric Vehicle Day at the Capitol where I was able to check different model electric vehicles and test ride an electric bike.

During last Wednesday’s session, we covered a lot of ground as we head into our final two weeks in Hartford. Our main focus this past session day was addressing a number of sunset provisions on vital programs that help protect our seniors, students, healthcare workers and other vulnerable populations. With the House’s passage of SB 493, we were able to align the end dates of four programs with the end date of the public health and civil preparedness emergency. To be clear we are not extending the governor's executive orders, just aligning dates. This will allow us to continue serving those in need through June 30, 2022.

Those programs:

- Provide data to local health officials

- Support emergency housing

- Protect renters facing eviction

- Employ nurse aides

HB5168: An Act Concerning Property Tax Exemptions For Property Used For Charitable Purposes

Our state's nonprofits have helped to guide many of our communities through the past couple years – providing critically needed support even as their own staffing levels and resources were strained. As those same nonprofits work to ensure they can meet the still increasing needs of our communities, the House took steps on Wednesday to ensure that nonprofit charitable property tax exemptions are protected.

HB5269: AAC Remote Meetings Under The Freedom of Information Act

In response to the pandemic, our world went more digital than ever before. While there were some struggles, we found that offering public meetings, both in person and virtually, offered increased flexibility and accessibility. With the passage of HB 5269, the House approved the ability to allow for a permanent option to the remote meetings that have helped so many residents more easily access their elected officials.

Does your household have earned income of less than $57,414? You may be eligible

to claim the Earned Income Tax Credit! When claiming three or more qualifying children, you can receive up to $6,728. There is no maximum age limit!

CHILD AND DEPENDENT CARE CREDIT

Did you spend money this year on care for a child or dependent while you worked or looked for work? You may receive a credit of up to $4,000 for care expenses for one qualifying person and up to $8,000 for two or more qualifying persons. Children or dependents must be under age 13 for the days the care was provided during the tax year, or be physically or mentally incapable of self-care.

STIMULUS PAYMENTS

In 2021, many citizens and residents qualified for a $1,400 payment and an additional $1,400 per dependent. All stimulus payments have been issued. If you qualify and did not receive the third stimulus payment, you will need to claim it as a credit on your 2021 income tax return.

CHILD TAX CREDIT

You may receive up to $3,600 for each child age 5 and under, $3,000 for each child age 6 through 17 at the end of 2021. There is no income limit to claim this credit in

2021. Qualifying children may include foster children or extended family if they meet other criteria.

TAX PREP ASSISTANCE IS AVAILABLE

If you made $58,000 or less in the tax year (or are 60 years of age and older with any income), you can file your federal and state taxes for free in person or virtually at a Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) program site. To find a VITA or TCE office near you, call 1-800-906-9887.

REMEMBER: YOU COULD RECEIVE A TAX REFUND EVEN IF YOU'RE NOT REQUIRED TO FILE!

If you have them, bring a government ID, permanent address, Social Security number/Individual Taxpayer Identification Number and bank account information

to your tax preparation appointment. Don't have any of the above? That's ok, too.

RENTERS' REBATE PROGRAM

If you are elderly or have a disability, you may qualify for the Renters' Rebate Program! You could end up with $700 ($900 for married couples) to help with your rent. The application process opens today and goes until October 1st.

🌐 Learn more and apply today: bit.ly/3IL9Nn8

📞 Call for more information: 860.418.6377

UTILITY COST ASSISTANCE

I recognize that these are not the easiest times for everyone. If you are struggling, please know that you are not alone and reach out to one of the resources below. They will be happy to help.

DV Resources: CTSafeConnect.org, 888-774-2900

Suicide Hotline: 800-273-8255

Children’s mental health services: www.connectingtocarect.org/support-services

My office is available to help connect residents to social services and programs to help individuals and families stabilize and improve their lives.

The Community Action Agency of Western CT can assist you in applying for a number of programs including: energy assistance, SNAP, VITA Income Tax Program and various community support services. Call 203-744-4700 to get started.

Sincerely,

Aimee Berger-Girvalo

State Representative