After months of negotiation and hearing input from residents across our state, I am happy to pass along great news. The House of Representatives passed a $24 billion state budget adjustment package which provides $600 million in tax relief for working families.

| Last year, we passed a bipartisan budget that didn’t raise taxes and made historic payments toward our pension debt. Because of our smart reforms, strong returns, and Federal aid, we are able to make vital investments in human services, childcare, education, children's mental health, and more, while also providing one of the largest tax cuts in CT history.

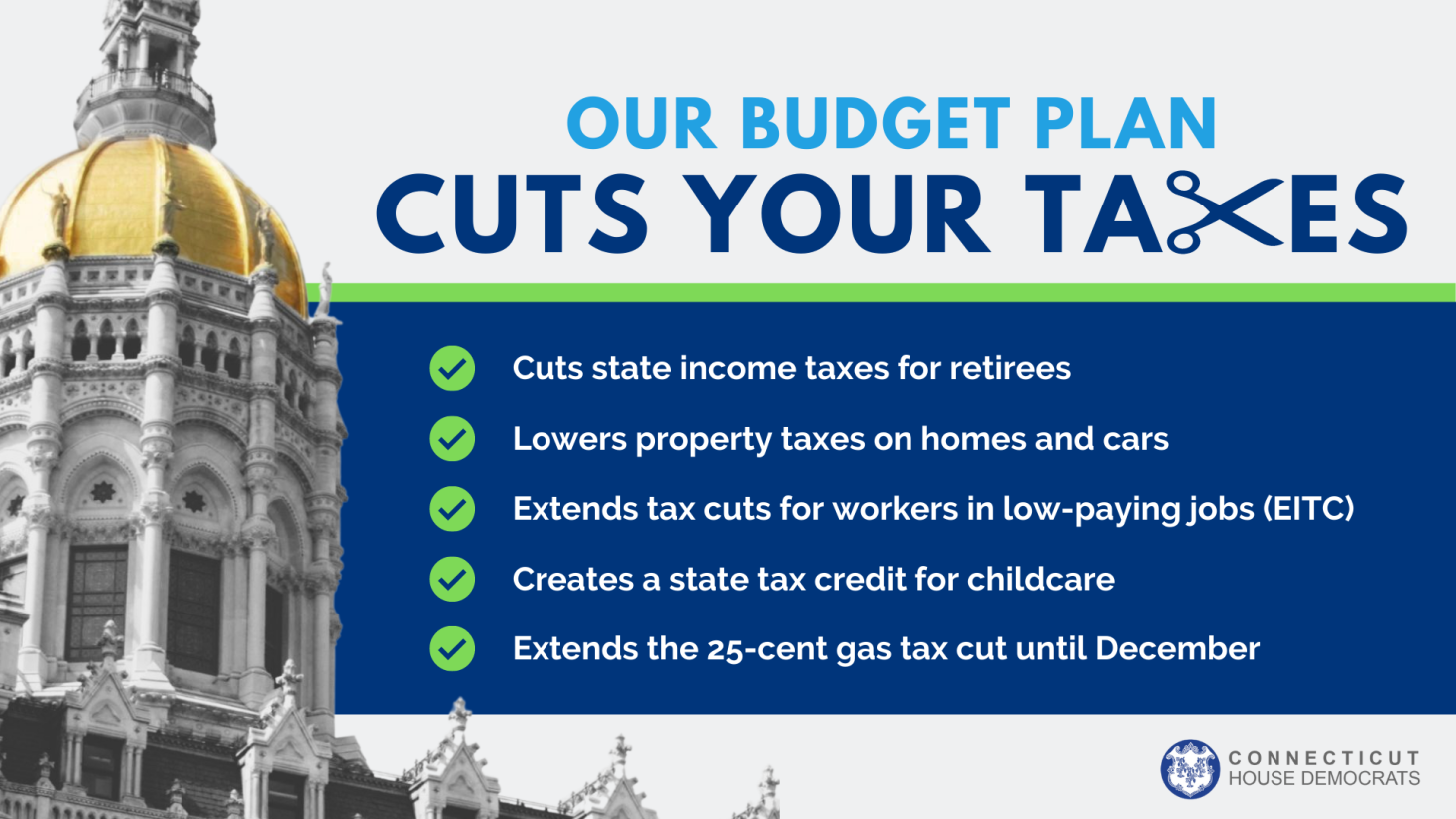

State Budget Highlights:

- Cuts state income taxes for retirees

- Lowers property taxes on homes and cars

- Extends tax cuts for workers in low-paying jobs (EITC)

- Creates a state tax credit for childcare

- Extends 25-cent cut to gas tax and free bus service until December

- Establishes a state child tax credit for income-eligible taxpayers for up to 3 dependent children under age 16

- Makes a historic $4.2 billion payment to CT's pension debt, saving taxpayers considerable money

- Provides a significant tax break for businesses on unemployment insurance

- Increased pay to childcare workers to attract and retain more educators

- Assist local schools in expanded mental health staff and access to care

- Creates new incentives for consumer and commercial electric vehicles

Fairfield will see an additional $1.2 million in total state aid for FY 23 over FY 22. This increase is largely from the tiered PILOT adjustment passed and kept from last year’s budget. I still continue to advocate for equitable reform and adjustments to the ECS formula for Fairfield. |

|

| The proposal now goes to the Senate for consideration. Lookout for more legislative updates later this week as we close out the session! |

|

|