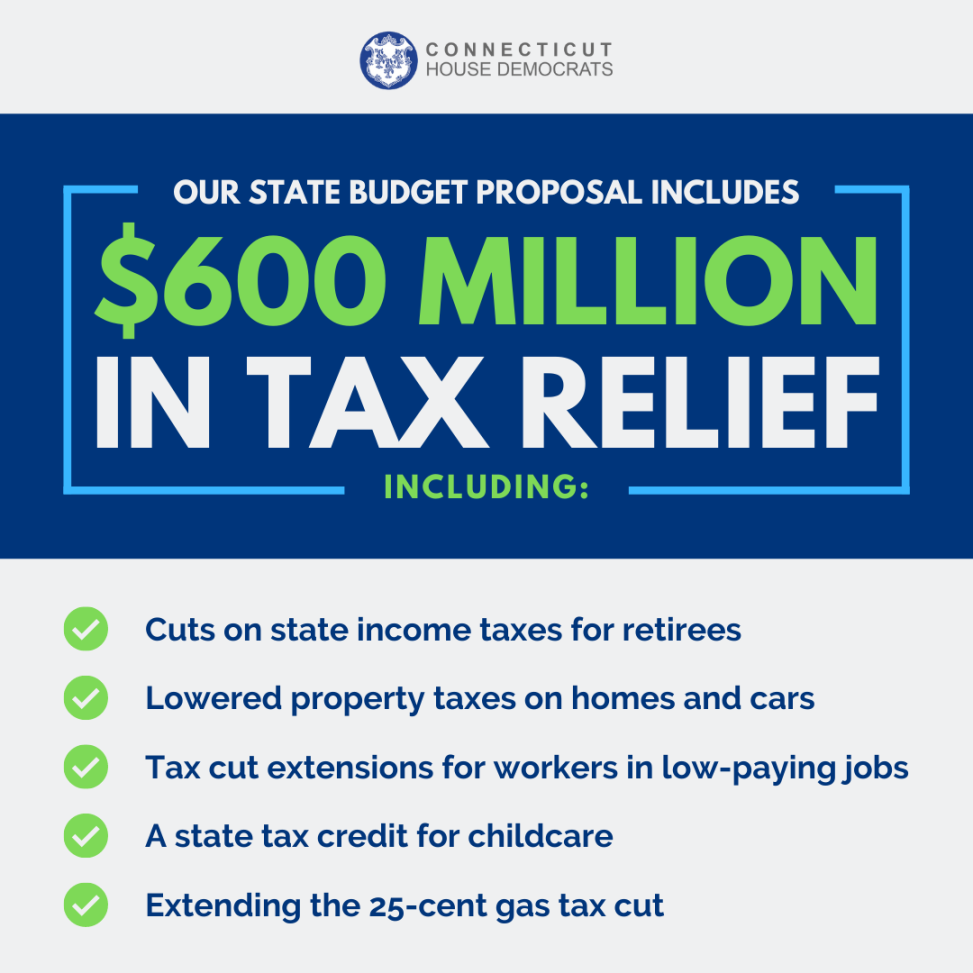

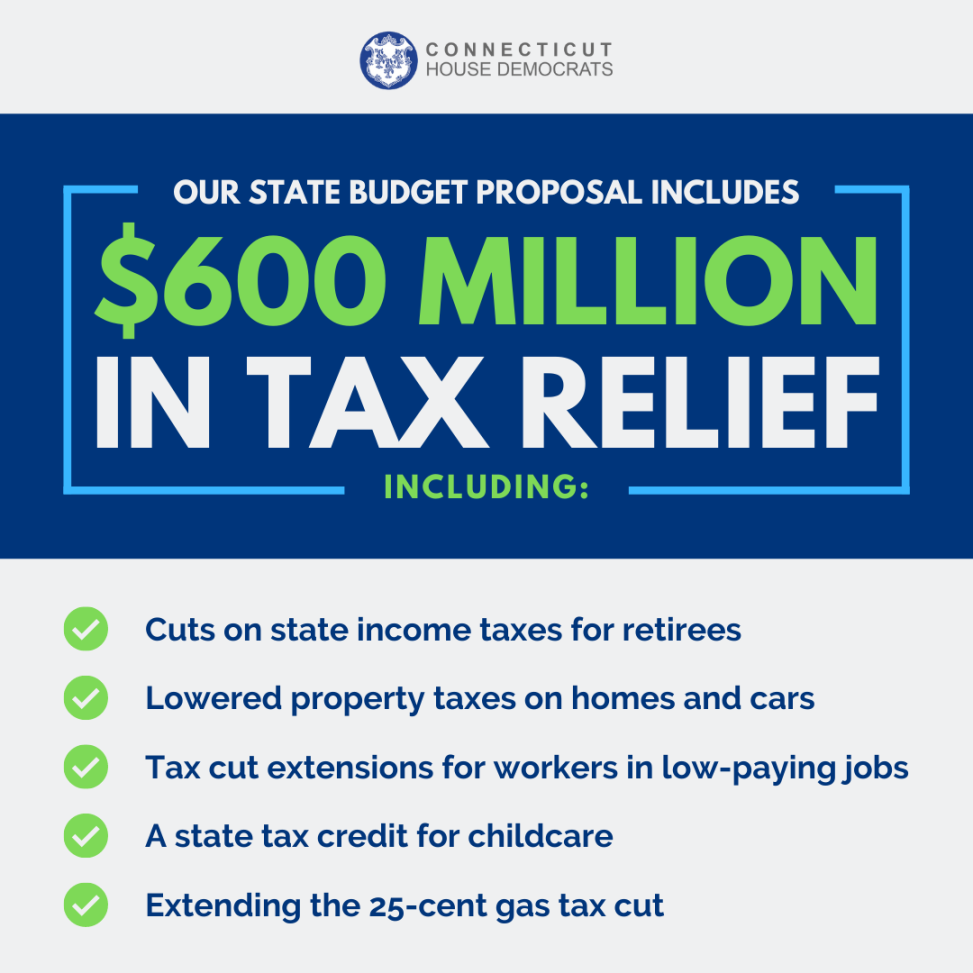

| Late Monday night, the House passed the State Budget. This historic budget contains $600 million in total tax relief for all of us, including child tax credits, a 100% exemption on retirement income, a cap on car taxes, increases to the Earned Income Tax Credit (EITC), and a continued suspension of the gas tax through December.

In addition, I am pleased to report that the budget contains the largest amount of total state aid to Hartford and Windsor ever granted.

- Hartford will receive $294,059,371 in total aid for Fiscal Year (FY) 23

- Windsor will receive $15,308,518 in total aid for FY 23

In this budget, we also established a new car tax cap, which will be set at 32.46 mills. No matter what mill rate the town sets above that, the mill rate for your car will be 32.46 mills. The Town will be reimbursed for any difference in tax revenue, which ensures your taxes won't be raised elsewhere.

- Hartford will be reimbursed $18,768,858 during FY 23

- Windsor will be reimbursed $205,072 during FY 23

In addition, none of our schools will see cuts in education cost sharing dollars – in fact we are receiving the most funding ever awarded. This builds on last year’s historic increase in education aid to provide our students with the support they need, and our residents with necessary property tax relief.

Below you will find more highlights from the state budget: |