REP. DOUCETTE HIGHLIGHTS PRIORITIES FOR 2022 LEGISLATIVE SESSION

(HARTFORD, CT) – With the 2022 legislative session well underway and the Committee process starting to wind down, State Representative Jason Doucette (D- Manchester, Glastonbury), House chair of the General Assembly’s Banking Committee, is announcing his support for several bills currently being considered within their respective committees.

“After listening to the varying concerns and thoughts of my constituents since the end of last year’s session, it is clear that there is a lot to accomplish before the 2022 legislative session ends in early May,” said Rep. Doucette. “This year I am focusing on several pieces of legislation delivering tax relief for low and middle-income families and workers, promoting equity and stability in our banking system as Chair of the Banking Committee, and addressing specific concerns brought forth by my constituents. With the committee deadlines coming up soon, I wanted to share with some of the bills I have introduced that are my priorities this year.”

Highlighted below are a variety of bills introduced by Rep. Doucette this session:

Banking Committee Bills

HB 5216: An Act Concerning Low-Cost Bank Accounts

At a time when around 40 percent of Americans report not being able to cover a $400 emergency expense, $400 in unexpected overdraft fees can increase a family’s economic insecurity. House Bill No. 5216 would establish a low cost, "basic" bank account which would limit overdraft and other fees.

HB. 5315: An Act Establishing a Financial Wellness Trust Fund and Authorizing the Treasurer to Establish a Center for Financial Wellness

In a recent nationwide survey, Connecticut received a failing grade in providing our young people with the financial knowledge they need to succeed. There is also a disparity in financial literacy across income levels which serves to exacerbate by the state’s growing wealth gap and racial wealth gap. House Bill No. 5315 would create a fund to promote financial education for citizens of Connecticut which would include a Center for Financial Wellness that could be established by the Treasurer. The Center for Financial Wellness would aim to improve financial literacy and the overall financial wellness of Connecticut residents by providing resources to provide financial literacy programs and partnering with community groups to provide these services.

SB 182: An Act Establishing a First-Time Homebuyer Savings Account and Tax Deduction

We all know Connecticut is a great place to live and work, but with home prices rising, there are barriers to entry for first-time homebuyers who want to stay in Connecticut. This bill establishes a savings account for first-time homebuyers and establishes a tax deduction that is equal to the amount they contribute to their account each year to incentivize first time homebuyers to stay here and plant roots.

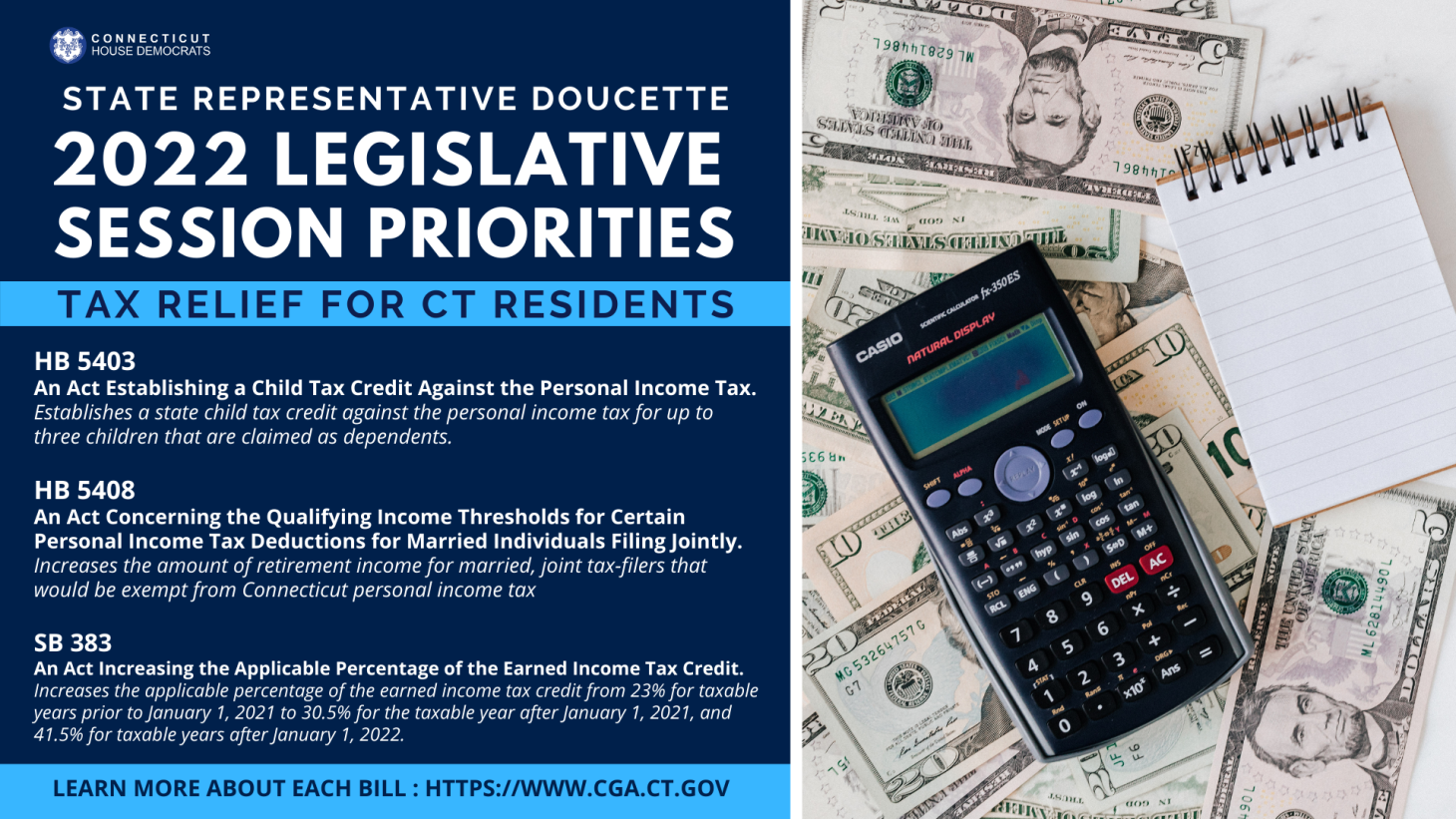

Tax Relief for Connecticut Residents

HB 5408: An Act Concerning the Qualifying Income Thresholds for Certain Personal Income Tax Deductions for Married Individuals Filing Jointly

Over the last few years, the legislature has taken steps to reduce taxes for seniors and retirees. This bill would further increase the amount of retirement income for married, joint tax-filers that would be exempt from Connecticut personal income tax to give our seniors a tax break.

HB 5403: An Act Establishing a Child Tax Credit Against the Personal Income Tax

The recent Federal child tax credit has proven to be effective not just in reducing child poverty now, but data has consistently shown it can have an impact on school achievement and development, as well. This bill establishes a state child tax credit against the personal income tax for up to three children that are claimed as dependents.

SB 383: An Act Increasing the Applicable Percentage of the Earned Income Tax Credit

Similarly, the Federal EITC has a proven track record of increasing opportunity, creating a powerful incentive to increase workforce participation, and reducing poverty. Senate Bill No. 383 increases the applicable percentage of the earned income tax credit from 23% for taxable years prior to January 1, 2021 to 30.5% for the taxable year after January 1, 2021, and 41.5% for taxable years after January 1, 2022.

Advocating for My Constituents

HB 5417: An Act Concerning Juvenile Justice and Services and Firearms Background Checks

I know crime is a concern for many this year, and there are numerous proposals currently pending in the Judiciary Committee for various changes to be made to our criminal justice and juvenile justice system. HB 5417 is the House Democrats’ crime bill, and I drafted a section of this bill on behalf of a constituent from Manchester whose family was victimized by a horrific crime. The bill also allows for faster arraignment and services for juvenile offenders, and also more rehabilitation and probationary programs serving juveniles and hopefully reducing crime and recidivism.

HB 5446: An Act Concerning Equal Coverage for Medically Necessary Infertility Treatments

A constituent from Glastonbury reached out to me after being denied insurance coverage for fertility treatments effectively because she was in a same-sex marriage. This bill would eliminate any such discrimination and make coverage of medically necessary infertility treatments more equal.

HB 5365: An Act Concerning Certificates of Title

A constituent from Manchester reached out to me with a problem they were having after buying a car online but not receiving the title to the vehicle until many months later. This bill would require online car dealerships, such as Carvana or Vroom, to provide the title of the car to the buyer at the time of delivery.

These bills are all either pending in Committee or awaiting further action in the House or Senate. To track these bills or for a full list of bills introduced or sponsored by Rep. Doucette, CLICK HERE.

###