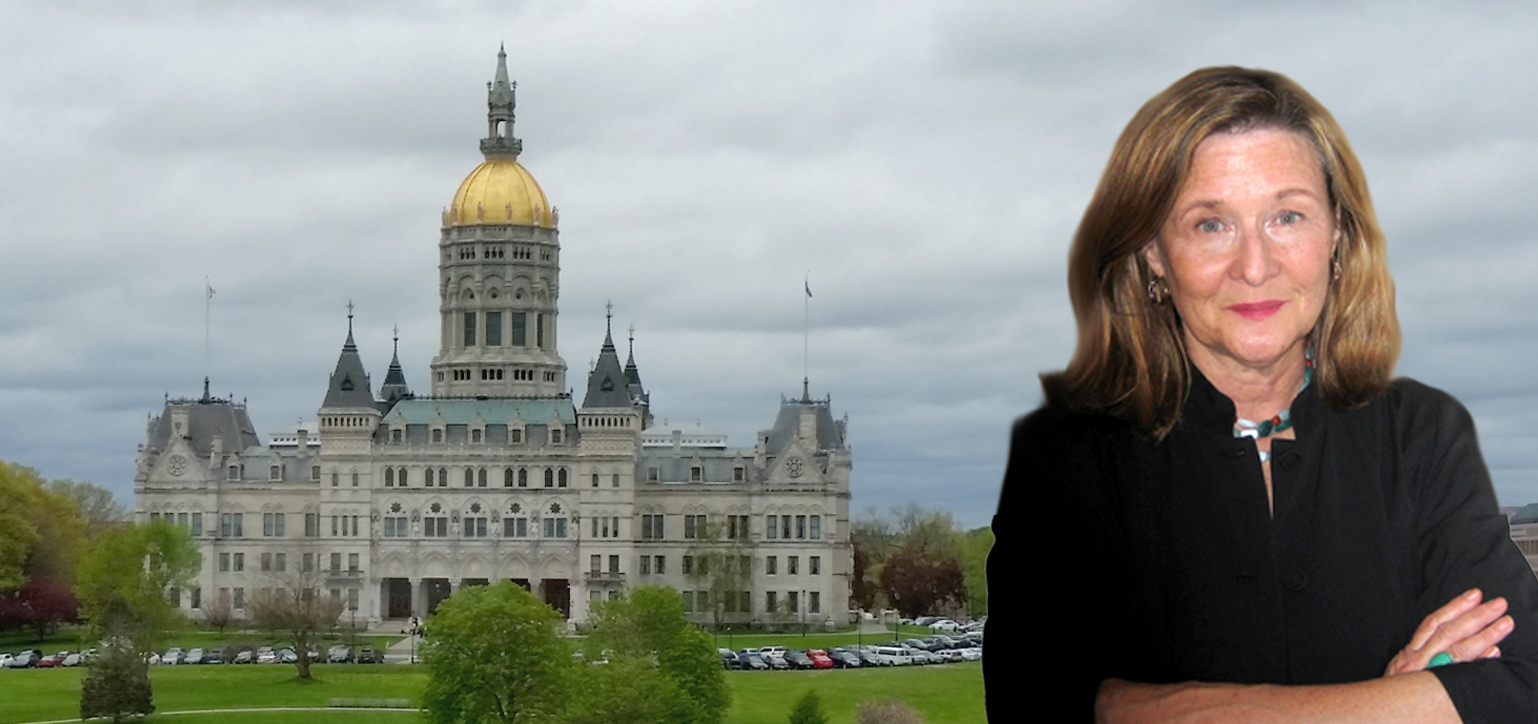

Governor signs PILOT legislation, others

Last week, Governor Lamont signed several measures passed by the House and Senate that help to move our state forward.

H.B. 6516 addresses constituent concerns with respect to inequitable taxation when working from home, burdens on those who once received state assistance, and allocation of PILOT - payment in lieu of taxes.

First, of importance to New Haven, H.B. 6516 modifies the PILOT program formula (payment in lieu of taxes) to give weight to the wealth of a town. S.B. 873 replaces the existing tiered system for PILOT payments, currently based on overall percentage of tax-exempt property, with new tiering based on grand list assessments adjusted for fair market value. Authored by Senator Looney, the new system will benefit New Haven because our equalized net grand list is less than $100,000 per capita. It’s a fairer system, and because it grandfathers towns that currently get PILOT dollars, it will rely on new revenue.

Second, H.B. 6516 prevents double taxing those who worked remotely from Connecticut due to COVID-19. It extends a state income tax credit for the 2020 tax year to Connecticut residents who paid income tax to another state if that state requires nonresident employees to pay income tax on income earned while working remotely due to COVID-19. The ‘double taxation’ is currently being contested.

Third, it repeals the practice of seeking repayment of state assistance years later from those who needed help in the past. The policy, known as a "welfare lien," treats public assistance as debt and blocks upward mobility and home-ownership. These liens, often a result of general assistance or medical debt, were only applied by two states.

H.B. 6515 prohibits workplace discrimination based on hairstyles that are commonly associated with people of color, such as Afros, Bantu knots, braids, cornrows, dreadlocks, and twists. With the passage of the CROWN Act, Connecticut becomes the 8th state to ban discrimination on the basis of natural hair or texture.

These measures mark the first steps in what I hope will be a productive session.