Federal Child Tax Credit

|

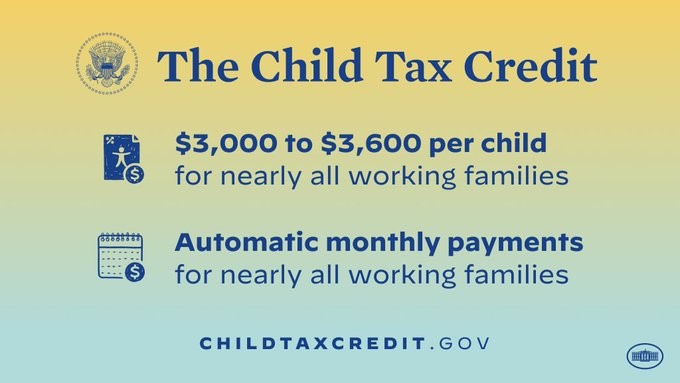

The Child Tax Credit in President Biden's American Rescue Plan helps hard-working families with the costs of raising children. Based on 2019 and 2020 tax returns, the IRS began issuing monthly child tax credits on July 15. More working families are included in the Child Tax Credit (CTC). Even households with an annual income up to $150,000 and single parents making as much as $112,500 are eligible. The American Rescue Plan increased the CTC from $2,000 to $3,000 for each child ages 6 to 17 – and $2,000 to $3,600 for each child under age 6. The age limit was also increased from 16 to 17. The Child Tax Credit is now the largest-ever child tax credit. The newly enacted tax credit is only for 2021 but President Biden strongly supports making it permanent. |

|