Budget Passes

June 5, 2019Last night, the Connecticut General Assembly passed the biennium budget, and it will be transmitted to Governor Lamont for his signature.

As a member of the Finance, Revenue, and Bonding Committee, I was able to review all revenue-generating items that were included in the budget, many of which received public hearings throughout the last 4 months.

This process has made it clear to me that 4 months is not nearly enough time to craft such a complex policy and my hope is that those of us who wish to see a more long term plan put in place for fiscal stability, meet throughout these next two years to prepare for the next budget cycle.

This budget was not perfect, in fact, far from it. But there were some great items in it that gave me the faith to support it. Below is a summary:

- Expanded coverage for mammograms and ultrasounds: Newington resident Jan Kritzman joined lawmakers representing Newington and me at many of our coffee hours to discuss her battle with breast cancer and the need for insurance companies to cover ultrasounds. This language was included in the budget.

- The budget came in under the spending cap by $200,000 in year 1 and $5M in year 2, with additional spending cuts in the executive branch expenditures and with 1,000 current vacant positions to remain unfilled.

Here’s a chart with employment numbers:

The Rainy Day Fund, which is set up to be our recession reserve account, is projected to have as much as $2.9B by the end of fiscal year 2021. State Comptroller Kevin Lembo has recommended we have at least $2.8B in the account to make it through a recession.

- The Medicare Savings Program was on the brink of being unfunded. We heard from many people throughout the community on this program’s importance, so it was left whole in the budget.

- The Teachers’ Pension Program was amortized over a longer period of time, yet the budget keeps up with current payments to the fund while not asking teachers to contribute more.

- Tax breaks were included in this budget. We eliminated the business entity tax, capitol stock tax, and extended the Angel Investor Tax Credit program

- We maintained funds for Tourism, Passport to the Parks, Energy Efficiency Fund, and PEGPETIA, which in previous years had been swept into the General Fund.

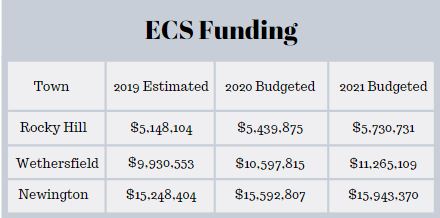

- Increases in town PILOT and Education Cost Sharing dollars:

The budget’s drawbacks are tax increases on the following:

- Internet streaming services like videos and music

- Dry cleaning and interior design services

- The sale of housing over $800,000

- An additional housing tax on homes over $2.5M when the owner leaves the state

- Plastic and paper bags/alcohol/vaping all have additional taxes

- Fees were increased from $35 to $100 on used car sales and from $20 to $100 on business registrations

The most controversial of the taxes was the new Pass Through Entity Tax (PET), which taxes LLCs and LLPs. PETs were able to offset the federal State and Local Tax deductions by 93% through a program put in place several years ago by the legislature. This budget reduces that rate to 87.5%.

I pushed hard against tax increases to ensure Connecticut’s residents could keep their hard-earned money in their pockets, but we had to make tough decisions in the budget negotiations.

The first iteration of the budget had an expansion of sales taxes across the board including real estate, attorney, architect, engineering, and boating. There was a 2% capital gains tax which would have raised the rate from 6.99% to 8.99%. I worked diligently to pull as many tax increases as possible from the budget.

There’s always more work to do and I’m confident we can work in a bipartisan way to achieve long-term stability.

My colleagues in the legislature's Bipartisan Women's Caucus honoring Lt. Governor Susan Bysiewicz.

Memorial Day Parade in Rocky Hill.

Women Business Leaders at the Capitol with Jennifer K. Muir, President of JKMuir, a Rocky Hill-based environmental engineering and energy consulting firm.