| Bills for Small Businesses

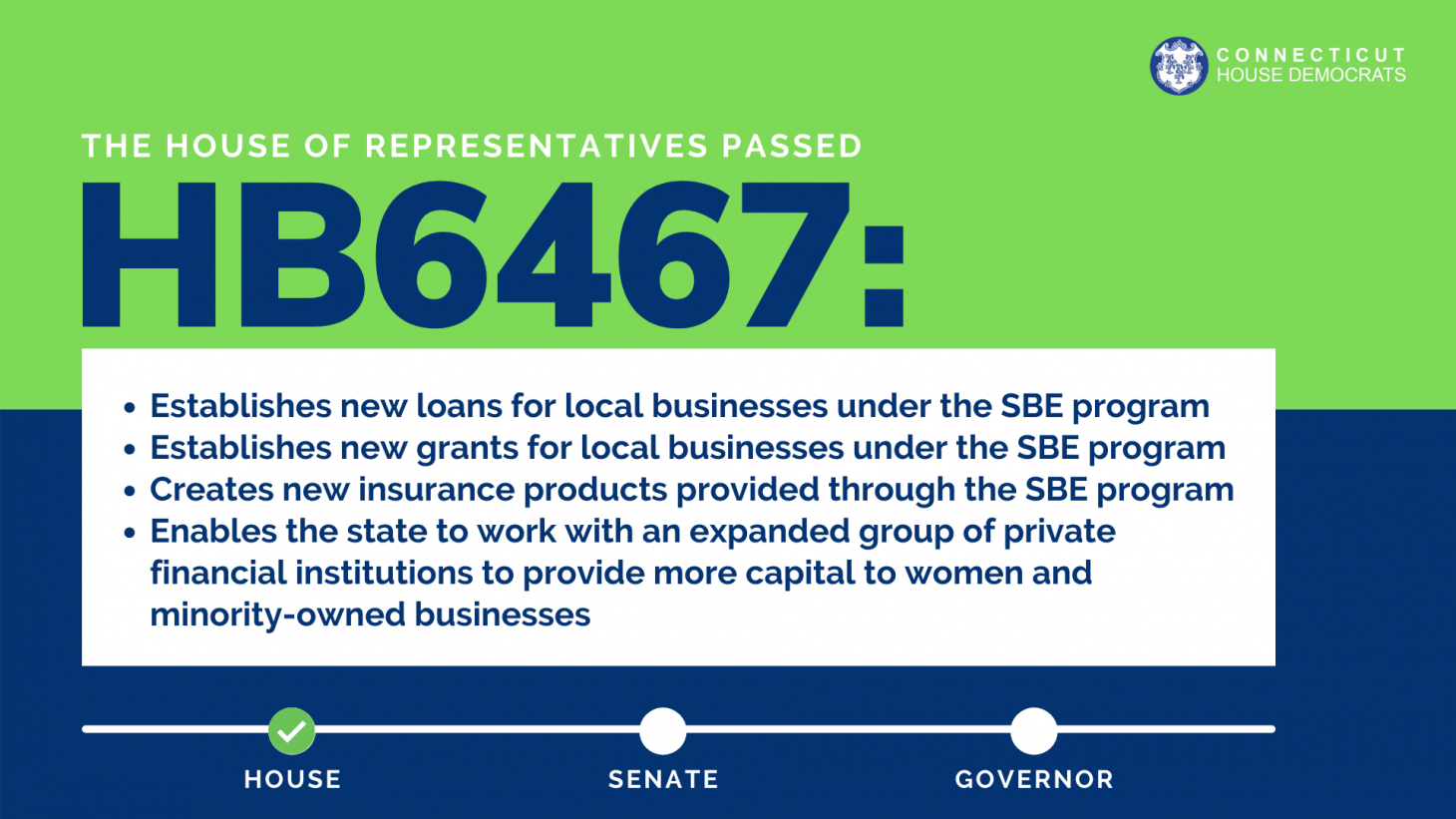

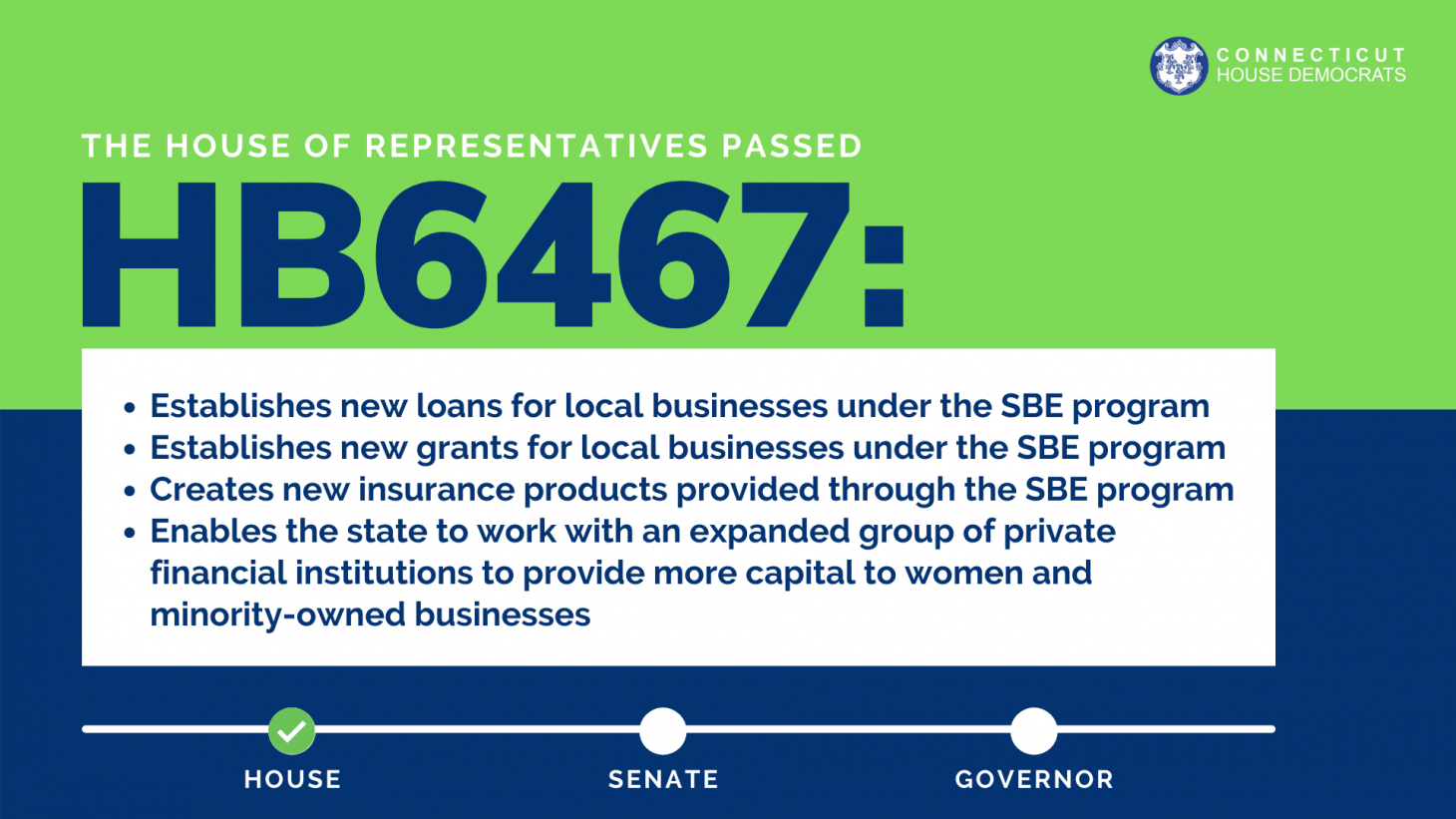

H.B. 6467, AN ACT CONCERNING THE SMALL BUSINESS EXPRESS PROGRAM.

Local businesses are at the heart of every community in Connecticut, but over the past year, they have been disproportionately affected by COVID-19. While a number of excellent loan and grant programs have been established to provide aid, many small businesses missed out due to the sheer demand and stiff competition. In an effort to aid small businesses and bolster our local economies, my colleagues and I made it a priority to expand and incentivize the state’s Small Business Express (SBE) Program by passing HB 6467. Funding from this program will help small businesses in our district to create additional jobs, acquire assets, and expand business operations.

CLICK HERE for more information about this bill.

H.B. 6602, AN ACT CONCERNING THIRD-PARTY DELIVERY SERVICES FOR RESTAURANTS.

COVID-19 has increased our reliance on third party delivery services – but that increased use has exposed some possible concerns with those delivery sources. HB 6602 protects small, local restaurants’ reputations and brands by ensuring these third party delivery sources cannot falsely suggest a relationship with a restaurant or take orders without first obtaining the restaurant’s written consent.

CLICK HERE for more information about this bill.

SB 3, AN ACT CONCERNING DIVERSE ECONOMIC OPPORTUNITY, WORKER PROTECTIONS AND SMALL BUSINESS REVITALIZATION

This bill aims to counter the economic obstacles brought on by COVID-19 and other underlying factors through economic stimulation. There are several components to SB 3 including: expanding the state’s stranded tax credit program (Stranded tax credits are those leftover when companies are limited in the amount of credits they can use during a given year. The legislature took action several years ago to allow companies to use these "stranded" credits to grow their businesses and increase employment. This bill, in part, simply expands this program.); requiring the Department of Economic and Community Development (DECD) to give priority to business applicants that demonstrate a willingness to make jobs available to individuals who meet certain criteria; and requiring DECD to develop and implement a plan to advertise certification programs, job training programs, and entry-level manufacturing jobs.

CLICK HERE for more information about this bill.

HB 6440, AN ACT ESTABLISHING THE JOBSCT TAX REBATE PROGRAM

This bill establishes the JobsCT Tax Rebate program, which will offer qualified, job-creating businesses a tax rebate. HB 6440 offers incentives to businesses that expand or relocate in one of the state’s designated opportunity zones or distressed municipalities.

CLICK HERE for more information about this bill.

In addition to these bills we passed at the state level, there are still certain federal programs available to help small businesses still struggling, including the COVID-19 Economic Injury Disaster Loan. To see if your business qualifies for this type of loan, please click HERE. |