2022 Tax Incidence Report Highlights

March 4, 2022The Department of Revenue Service recently released the 2022 tax incidence report. This report highlights a huge disparity between taxpayers around the state.

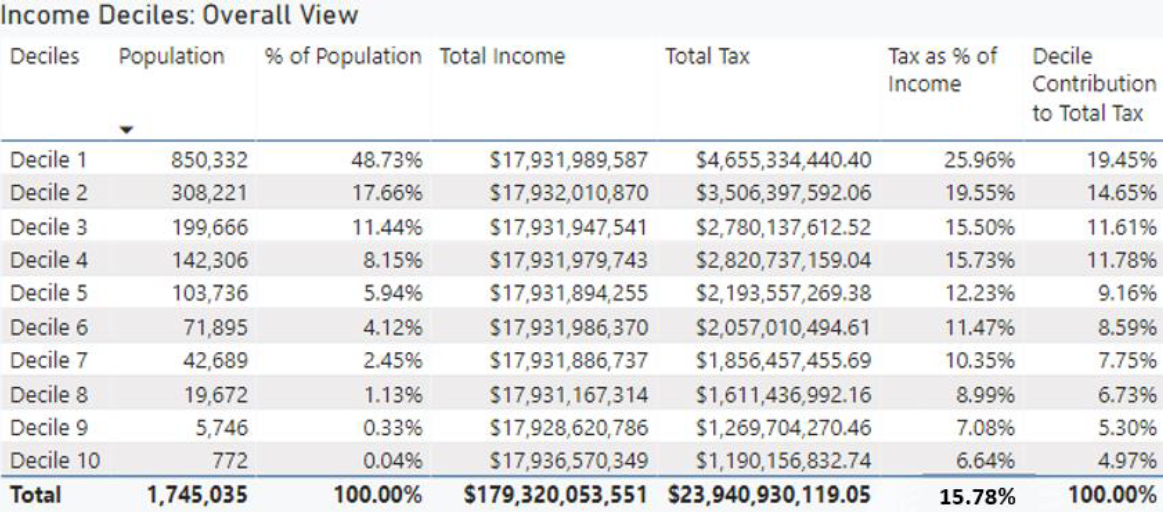

The figure below shows that nearly 50% of taxpayers in Connecticut pay 26% of their income in taxes. This figure reveals that most of our state's taxpayers are doing the heavy lifting.

Why This Report is Important?

A report like this needs to regularly be conducted to get more than a snapshot of what the majority of taxpayers face but to understand the moving target. Data from the last tax incidence report is from 2014.

Fellow legislatures also agree that this report is important to understand how the current tax structure impacts families all across Connecticut and the appropriate changes in policy that need to be made.

In 2019, I voted for a bill that was signed into law commissioning a tax incidence report be conducted every two years.

I pledge to fight for residents in my district and statewide to ensure a more equitable tax structure.

What's next?

The Governor announced today his tax cuts proposal that would offer relief to many middle class residents in our state.

These cuts include:

- Lowering the mill rate to 29

- A property tax cut (increasing credit from $200 to $300)

- Eliminating income tax on pensions and 401ks,

- A 50% tax credit on student loans if college graduates take job in Connecticut.

My fellow colleagues applaud the Governor's proposal and want to take that a step further by permanently increasing the Earned Tax Income Credit to 41.5%.

This will be a relief to many middle class residents in the state and is a good time to do so with the state being in a surplus.