Historic Tax Cuts

January 9, 2024As a result of fiscally responsible budgeting by the legislature and governor, significant tax relief is on the way for many Connecticut taxpayers in 2024.

Three tax relief measures went into effect on January 1, including the largest income tax cut in state history, an increase in a tax credit aimed at the lowest-income workers, and an expansion of exemptions on certain pension and annuity earnings that will benefit seniors.

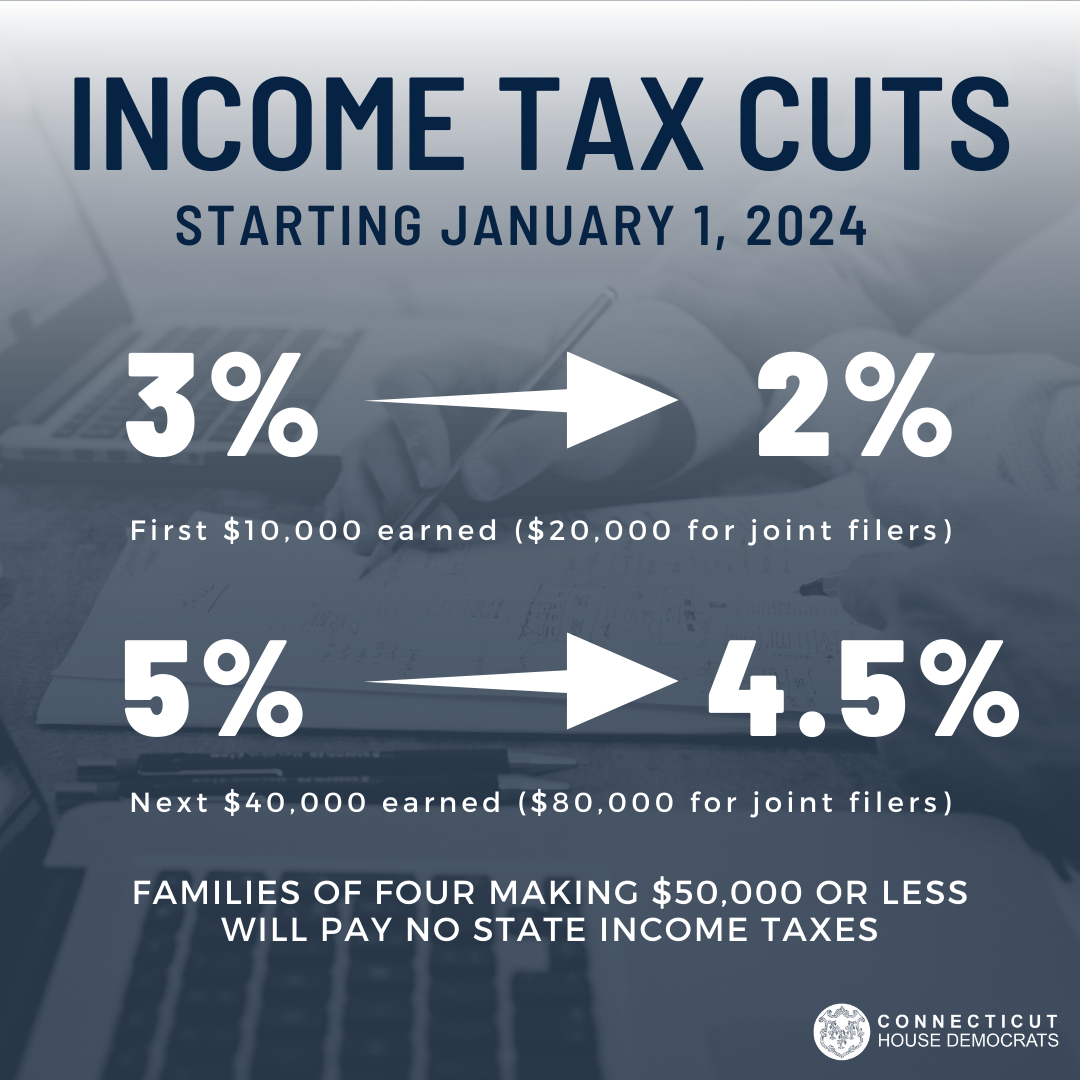

One million filers will benefit from a decrease in the rates for the two lowest state income tax brackets:

- The 3% rate on the first $10,000 earned by single filers and the first $20,000 by joint filers will drop to 2%.

- The 5% rate on the next $40,000 earned by single filers and the next $80,000 by joint filers will drop to 4.5%.

The relief targets middle-class tax filers and is capped at $150,000 for single filers and $300,000 for joint filers. This is the first time that rates have been reduced in the state since the mid-1990s and represents the largest income tax cut enacted in state history.

For a closer look at the new rates by income, single filers click here. For joint filers, click here.

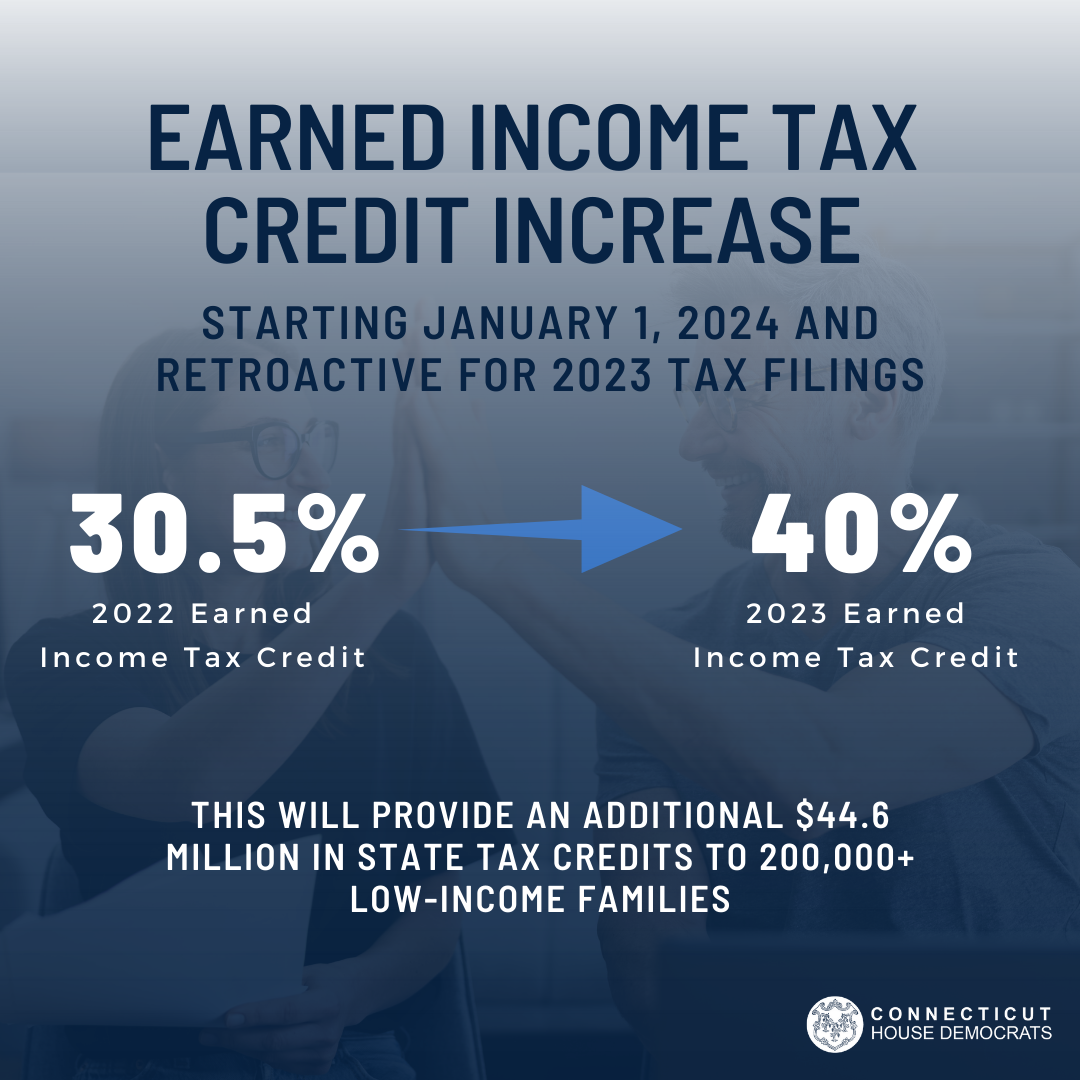

In addition, Connecticut’s Earned Income Tax Credit for low-income workers becomes one of the largest in the U.S.

The EITC in Connecticut is increasing from 30.5% to 40% of the federal EITC and will provide an additional $44.6 million in state tax credits to the approximately 211,000 low-income filers who receive the credit. More than 95 percent of these filers are families with children.

The Connecticut EITC is a refundable state income tax credit for the lowest income working individuals and families that mirrors the federal EITC.

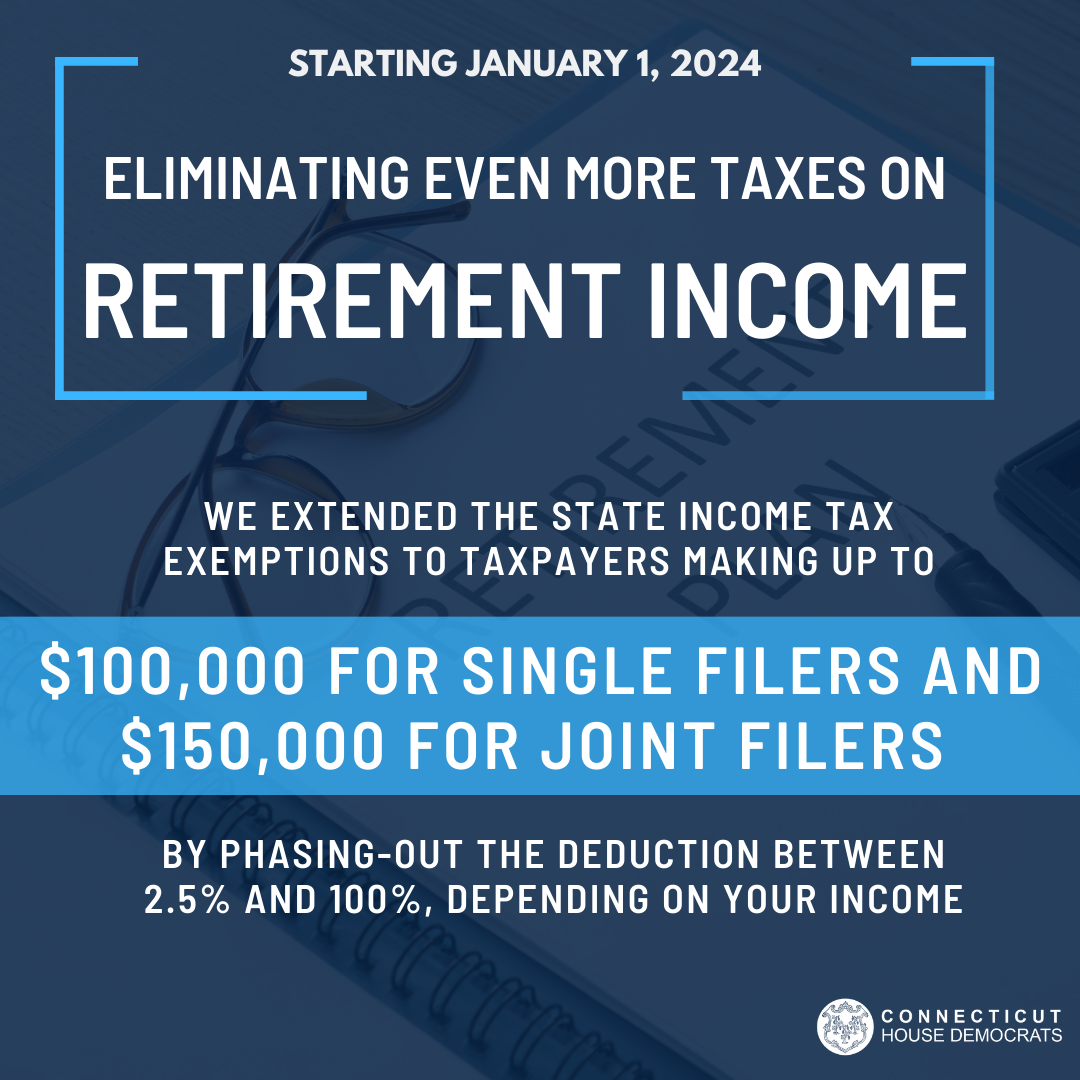

Also, we are expanding certain deductions for IRA distributions and pension and annuity earnings for seniors by eliminating the so-called "retirement income tax cliff" by adding a phase-out for allowable pension annuity and IRA distribution deductions against the personal income tax.

Approximately 200,000 filers benefit from the currently enacted retiree exemption limits. It is estimated that with these changes, an additional 100,000 filers could benefit from the elimination of the retirement cliff via the exemption phase-out.

These historic tax cuts are a result of the state budget passed during the 2023 legislative session to help provide relief for many of our hardest-working state residents. The three measures will reduce tax burdens on CT taxpayers by $460 million and will also help boost our economy with increased consumer spending.